Abhishek Sinha

Advisory on reporting values in Table 3.2 of GSTR-3B

Auto-Populated Table 3.2 of GSTR-3B to Become Non-Editable from July 2025 The GSTN has reintroduced an important compliance requirement regarding the auto-populated values in ...

Capital Gains Tax on Property Sale – How to Save LTCG Tax in FY 2025-26 ?

Did you earn capital gains recently by selling a property and now find yourself confused about how capital gains tax works on such transactions? ...

TDS Under Section 194S of Income Tax Act: How to Claim, Limit & Detailed Guide (FY 2025-26)

The Income Tax Section for TDS under Section 194S was introduced via the Finance Act 2022, as the Government of India wants to take ...

TDS Rate Chart for FY 2025-26 (AY 2026-27)

Here is a comprehensive TDS rate chart for FY 2025-26 (AY 2026-27), covering various payments and applicable sections under the Income Tax Act. Understanding ...

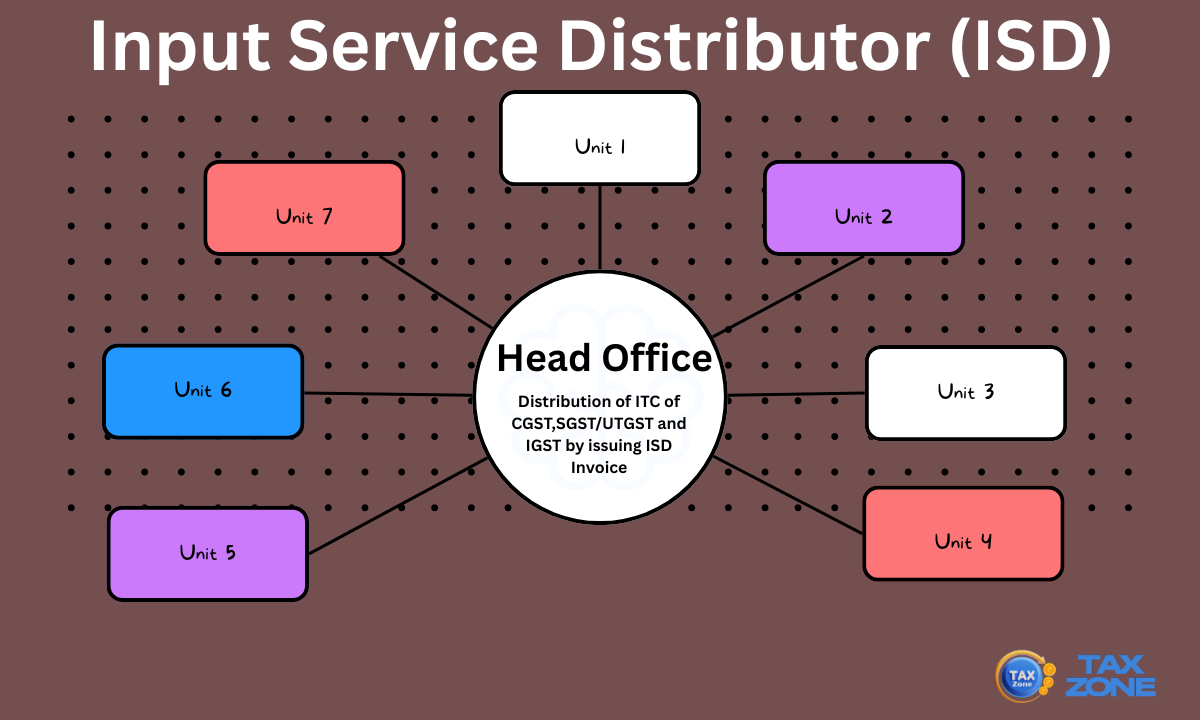

Input Service Distributor (ISD) Under GST

An Input Service Distributor (ISD) under GST refers to a specific category of taxpayer under the GST framework, responsible for distributing the Input Tax Credit ...

9 Big Changes in ITR-1 to ITR-4 You Must Know Before Filing Your Income Tax Return (FY 2024-25 | AY 2025-26)

Filing ITR for FY 2024-25? Don’t Miss These 9 Big Changes in ITR-1 to ITR-4 The Income Tax Department has notified revised ITR forms ...

VLOOKUP Formula in Excel :A Step-by-Step Guide with Examples

VLOOKUP Formula in Excel: A Step-by-Step Guide with Examples Introduction to VLOOKUP VLOOKUP Formula in Excel is one of Excel’s most powerful and widely ...

Capital Gains Impact on Section 87A Threshold

Income Tax Rebate Confusion: Capital Gains Impact on Section 87A Threshold Explained The 2023 Budget introduced a significant change in the income tax rebate ...

Income Tax Slab FY 2025-2026

Income Tax Slab FY 2025-2026 The Union Budget 2025 has reshaped the income tax landscape, bringing key revisions to tax Income Tax Slab FY ...

TDS Rate Chart FY 2025-2026(Proposed)

TDS Rate Chart FY 2025-2026(Proposed) Section Nature of Payment Existing Threshold Limit (₹) Proposed Threshold Limit (₹) Existing TDS Rate Proposed TDS Rate Remarks ...