Abhishek Sinha

HSN Validations in Table 12 of GSTR-1/1A

HSN Validations in Table 12 of GSTR-1/1A The recent Advisory on HSN Validations in Table 12 of GSTR-1/1A, effective from the January 2025 return ...

PAN 2.0 Project : New PAN Card With QR Code

The Cabinet Committee on Economic Affairs (CCEA) has given its nod to the PAN 2.0 Project, an ambitious initiative by the Income Tax Department ...

Blocked Input Tax Credit under GST – Section 17(5) of the CGST Act

Blocked Input Tax Credit: Overview of Section 17(5) of CGST Act 2017 Regarding Blocked Input Tax Credit, Section 17(5) of the CGST Act, is ...

Time Limit for Reporting e-Invoices on the IRP Portal

The Goods and Services Tax Network (GSTN) has announced a crucial update to the e-Invoicing requirements for businesses with an Annual Aggregate Turnover (AATO) ...

Income Tax Slab in India for Financial Year 2024-25 (AY 2025-2026)-New & Old Regime

As individual taxpayers prepare their finances for the Financial Year (FY) 2024-25 (Assessment Year 2025-26), understanding applicable income tax slabs and additional taxes like ...

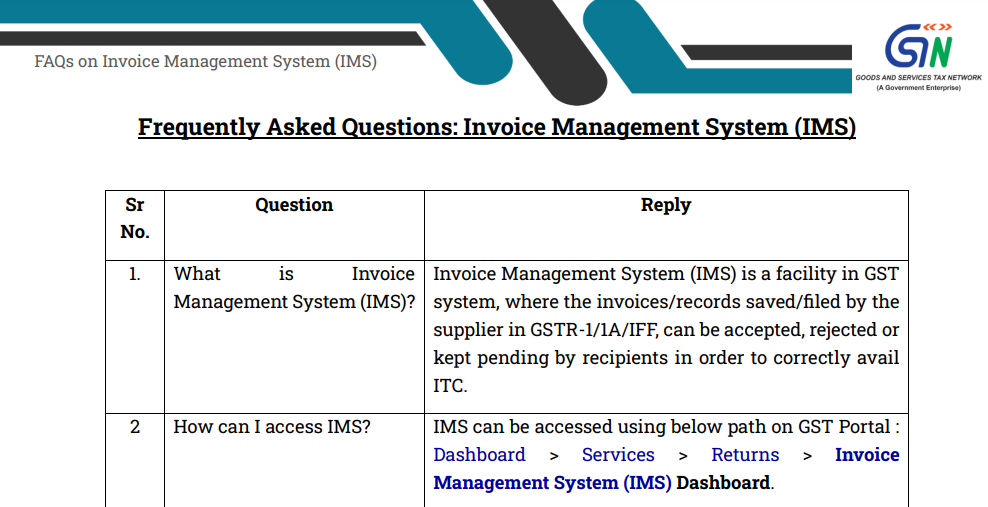

GST-Invoice Management System (IMS) and Its Functionality

The Invoice Management System (IMS) is a new feature introduced on the GST portal to help taxpayers manage and validate invoices with ease. This ...

TDS Rate Chart FY 2024-2025

Below is a detailed TDS Rate Chart based on the current provisions of the Indian Income Tax laws for FY 2024-25, along with the ...

CBIC Notification No. 09/2024 – Central Tax (Rate): GST on Renting of Commercial Property by Unregistered Persons

Introduction On 8th October 2024, the Central Board of Indirect Taxes and Customs (CBIC) issued Notification No. 09/2024-Central Tax (Rate). This notification amends an ...

Cost of Non-Compliance with TDS and TCS in India: Prevention and Penalties

Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) are key components of the Indian tax system that ensure taxes are collected ...