GST

Advisory on reporting values in Table 3.2 of GSTR-3B

Auto-Populated Table 3.2 of GSTR-3B to Become Non-Editable from July 2025 The GSTN has reintroduced an important compliance requirement regarding the auto-populated values in ...

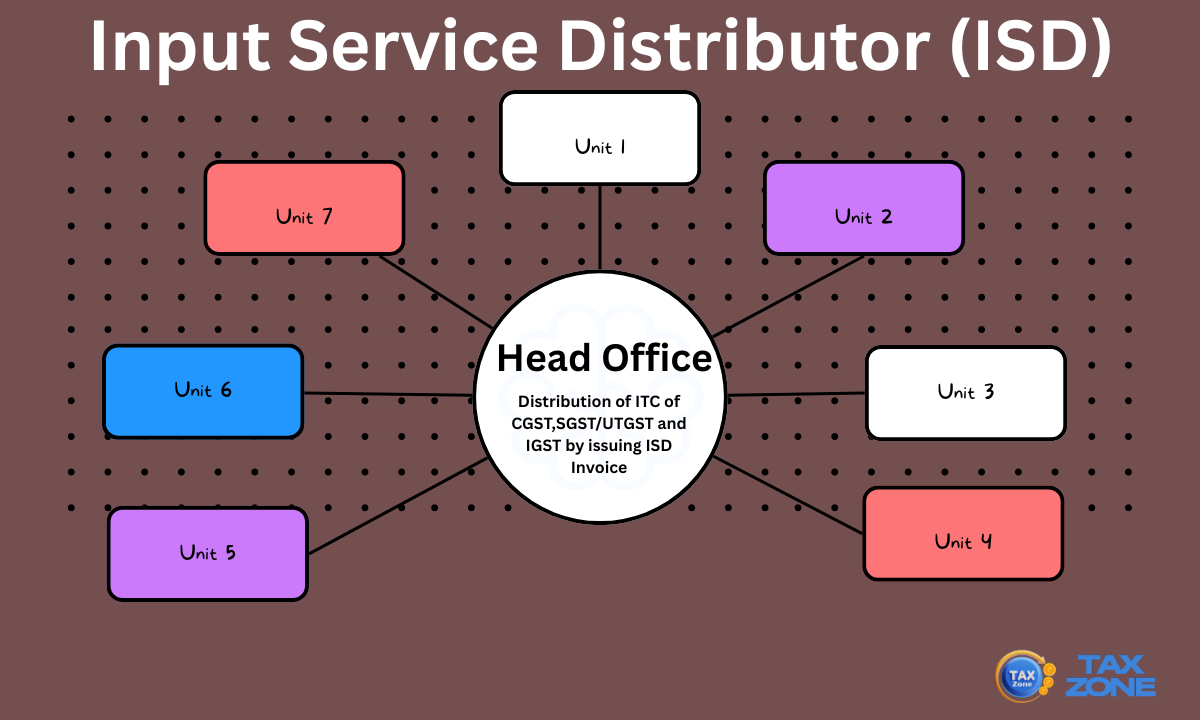

Input Service Distributor (ISD) Under GST

An Input Service Distributor (ISD) under GST refers to a specific category of taxpayer under the GST framework, responsible for distributing the Input Tax Credit ...

HSN Validations in Table 12 of GSTR-1/1A

HSN Validations in Table 12 of GSTR-1/1A The recent Advisory on HSN Validations in Table 12 of GSTR-1/1A, effective from the January 2025 return ...

Blocked Input Tax Credit under GST – Section 17(5) of the CGST Act

Blocked Input Tax Credit: Overview of Section 17(5) of CGST Act 2017 Regarding Blocked Input Tax Credit, Section 17(5) of the CGST Act, is ...

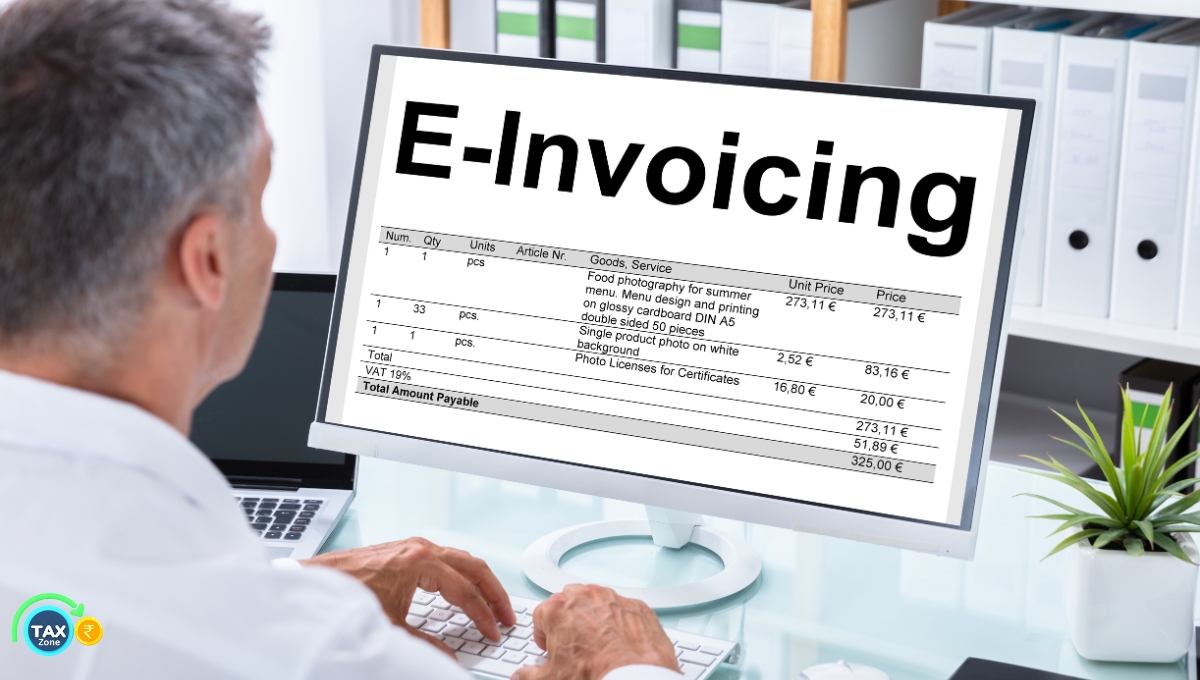

Time Limit for Reporting e-Invoices on the IRP Portal

The Goods and Services Tax Network (GSTN) has announced a crucial update to the e-Invoicing requirements for businesses with an Annual Aggregate Turnover (AATO) ...

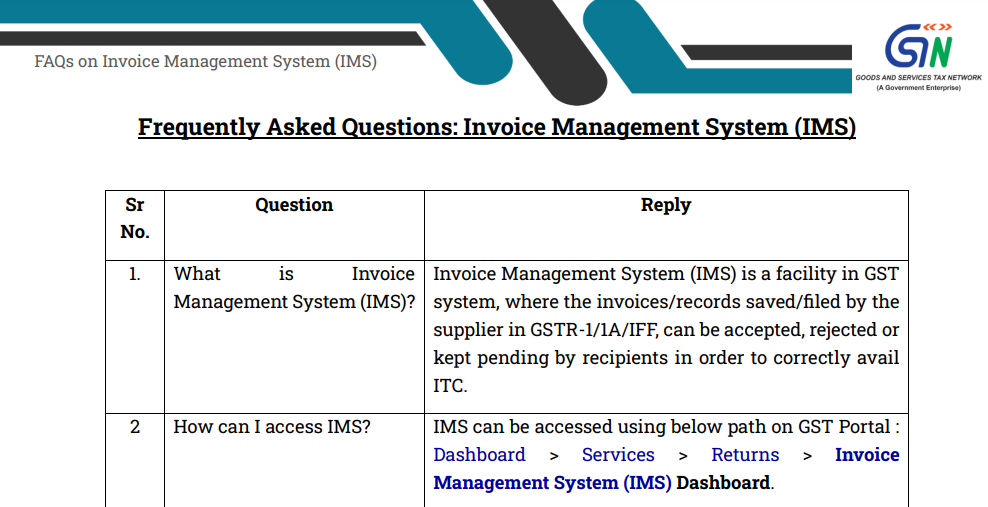

GST-Invoice Management System (IMS) and Its Functionality

The Invoice Management System (IMS) is a new feature introduced on the GST portal to help taxpayers manage and validate invoices with ease. This ...

CBIC Notification No. 09/2024 – Central Tax (Rate): GST on Renting of Commercial Property by Unregistered Persons

Introduction On 8th October 2024, the Central Board of Indirect Taxes and Customs (CBIC) issued Notification No. 09/2024-Central Tax (Rate). This notification amends an ...

GST Invoice Management System-Additional FAQ

The Invoice Management System (IMS) is now active and ready to help you manage your invoices more efficiently while ensuring accurate claims for Input ...