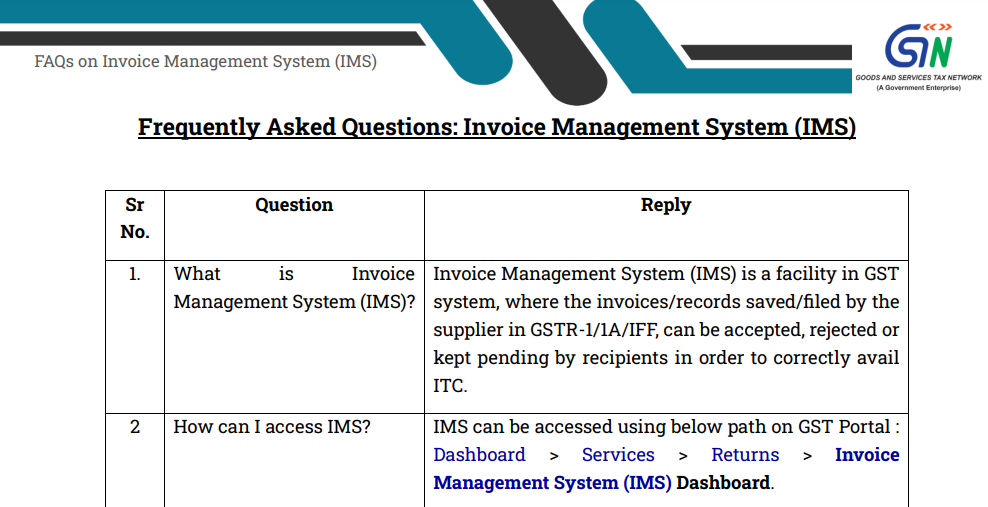

The Invoice Management System (IMS) is a new feature introduced on the GST portal to help taxpayers manage and validate invoices with ease. This system is aimed at reducing errors and ensuring that the Input Tax Credit (ITC) claimed by taxpayers is based on authentic and accurate invoices.

Key Features of IMS

- Introduction and Purpose:

The IMS enables taxpayers to match invoices with their suppliers, ensuring correctness before claiming ITC. The system allows recipients to either accept, reject, or keep invoices pending for later review.- Example:

Suppose a business receives an invoice for the supply of goods from a vendor. Before claiming ITC on the purchase, the recipient can review the invoice on the IMS dashboard. If everything matches their records, they can accept it, and it will reflect in their GSTR-2B for ITC. If there is a discrepancy, the business may reject the invoice.

- Example:

- Actions on Invoices: Once the supplier uploads invoices in GSTR-1 / IFF / GSTR-1A, the recipient has the following options:

- Accept: The accepted invoice will be included in the recipient’s GSTR-2B and considered for ITC.

- Reject: Rejected invoices will not be part of GSTR-2B, and ITC will not be claimed.

- Pending: If unsure, the recipient can keep the invoice pending. It won’t be included in GSTR-2B for that month but can be reviewed later.

- Example:

A retailer buys goods from a distributor but notices discrepancies in the quantity or price on the invoice. Instead of accepting or rejecting it immediately, the retailer can keep the invoice pending in IMS. Once the discrepancies are resolved, they can accept or reject it in the subsequent month.

- Deemed Acceptance: If no action is taken on an invoice by the time GSTR-3B is filed, it will be deemed accepted and included in GSTR-2B.

- Example:

If a taxpayer is busy and does not check the invoices listed in IMS before filing GSTR-3B, the system will automatically consider all pending invoices as accepted. These invoices will then appear in GSTR-2B, and ITC will be calculated accordingly.

- Example:

- Amendments and Updates: If a supplier makes changes to an invoice after it is uploaded, the amended invoice will replace the original in the IMS. If the amendment occurs after the filing of GSTR-1, the amended details will be reflected in the recipient’s GSTR-2B for the subsequent month.

- Example:

A supplier notices that the tax rate on an earlier invoice was incorrect and amends it before filing their GSTR-1. The updated invoice replaces the original in the IMS dashboard. If the original invoice was already accepted, the recipient will see the amended invoice and can take the appropriate action.

- Example:

- Pending Invoices: Invoices that are kept pending can be addressed in future months. However, they must be finalized before the deadline prescribed under Section 16(4) of the CGST Act, 2017.

- Example:

A business receives an invoice in January but wants to verify the details with its supplier. They keep it pending in IMS and resolve the issue by March. They can accept the invoice in March and claim ITC in their March GSTR-3B, as long as it is within the prescribed time limit for that financial year.

- Example:

Workflow of IMS

- Invoice Upload by Supplier: Suppliers upload invoices in GSTR-1 / IFF / GSTR-1A, which then populate on the recipient’s IMS dashboard.

- Example:

A supplier uploads an invoice for the sale of goods in their GSTR-1. The recipient can now see this invoice in their IMS dashboard and take the appropriate action (accept/reject/pending).

- Example:

- Actions by Recipient: Recipients review the invoices and take actions before filing GSTR-3B.

- Example:

A manufacturer reviews all invoices received in the month of April and accepts the valid ones. These invoices are then included in GSTR-2B, allowing the manufacturer to claim ITC for April.

- Example:

- GSTR-2B Generation: On the 14th of every month, a draft GSTR-2B is generated for the recipient based on the actions taken in IMS. If any action is taken after the 14th, the recipient must recompute their GSTR-2B.

- Sequential GSTR-2B: GSTR-2B will not be generated for a new period until the previous period’s GSTR-3B is filed.

- Example:

A company that has not filed GSTR-3B for January will not be able to generate GSTR-2B for February. The system will require the January filing before allowing the next month’s GSTR-2B to be created.

- Example:

- QRMP Scheme: For QRMP (Quarterly Return, Monthly Payment) taxpayers, invoices reported in IFF will flow to IMS, and GSTR-2B will be generated on a quarterly basis.

- Example:

A small business under the QRMP scheme will see invoices for the quarter being populated in IMS, but GSTR-2B will only be generated after the quarter ends, not monthly.

- Example:

Compliance and ITC Flow

- Amendments: If the supplier makes any amendment after the invoice is accepted or rejected, the amended invoice will automatically replace the original on the IMS dashboard.

- Rejection Impact on Supplier: If an invoice is rejected, the supplier’s liability will increase for that tax period.

- Example:

A retailer rejects an invoice for faulty goods in IMS. The supplier must account for the increased liability in their GSTR-3B for the rejected invoice in the subsequent month.

- Example:

- Pending Invoices: If invoices remain pending, the taxpayer can take action on them in subsequent months, but must finalize them before the due date prescribed by the CGST Act.

Conclusion

The Invoice Management System (IMS) is a significant step forward in simplifying invoice validation and ITC claims. It gives taxpayers more control over the invoices they process and reduces the risk of errors in ITC claims. By allowing actions like accept, reject, or keep pending, IMS ensures that taxpayers only claim ITC on valid invoices, helping businesses maintain compliance with the GST framework.