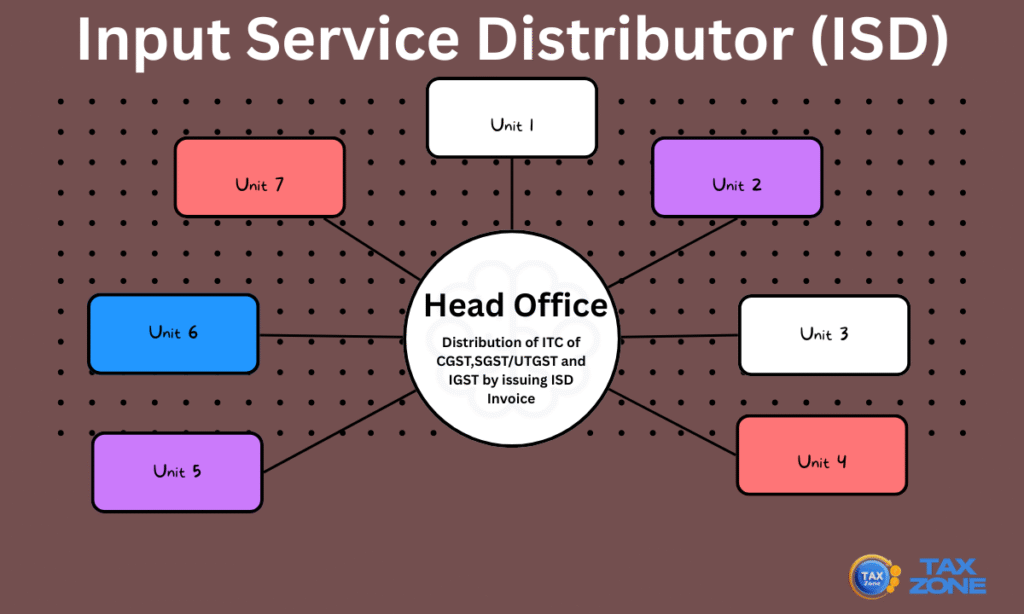

An Input Service Distributor (ISD) under GST refers to a specific category of taxpayer under the GST framework, responsible for distributing the Input Tax Credit (ITC) received on common input services to its multiple registered units (with separate GSTINs) that share the same PAN.

Starting 1st April 2025, it has become mandatory for businesses that receive invoices for common input services (used across multiple GST registrations) to obtain an Input Service Distributor (ISD registration. These businesses must comply with ITC distribution rules and begin filing GSTR-6 monthly.

| Key Developments on ISD Provisions

1st February 2025 – Budget Announcement In the Union Budget 2025, the government amended:

Note: This provision will become enforceable once the related notification is officially issued. 6th August 2024 – ISD Made Mandatory Before this date, the Input Service Distributor (ISD registration was voluntary. However, through Notification No. 16/2024 – Central Tax, the government:

10th July 2024 – Rule 39 Updated

Suppose your organization operates with multiple GSTINs and receives centrally billed services (such as consulting, audit, or IT services). In that case, it is essential to register as an ISD and start preparing to distribute ITC as per the revised legal framework. |

What is an Input Service Distributor (ISD) Under GST?

An Input Service Distributor (ISD) is a GST-registered entity that centrally receives invoices for input services that are commonly used by its multiple units or branches, which may be located in different states or union territories. The ISD is responsible for distributing the Input Tax Credit (ITC) proportionately to these units through ISD invoices.

Key Point: All such recipient units must be registered under different GSTINs but share the same PAN as the ISD.

Practical Example to Understand ISD Functionality:

Let’s consider M/s ABC Limited, whose corporate head office is based in Bangalore. The company has regional offices (branches) in Chennai, Mumbai, and Kolkata.

Now, suppose the head office procures an annual software maintenance service, which is centrally billed and used by all four locations.

- The invoice is received by the Bangalore HO, and it contains GST charged on the entire service value.

- Since this service benefits all offices, Bangalore cannot claim the entire ITC.

- Instead, the Input Tax Credit must be distributed to Chennai, Mumbai, and Kolkata based on a reasonable and prescribed allocation method.

In this scenario, the head office in Bangalore acts as the Input Service Distributor (ISD) and must distribute the ITC appropriately via ISD invoices to each of the beneficiary branches.

This mechanism ensures a fair and transparent distribution of credit and avoids the wrongful accumulation of ITC at one location. It’s particularly relevant for companies operating across multiple states with centralized procurement of services such as audit, legal, consultancy, insurance, or IT support.

Who Can Register as an Input Service Distributor (ISD) Under GST?

Not every business entity is required to register as an Input Service Distributor (ISD) under GST. This special registration is necessary only when specific conditions are met. Here are the eligibility conditions that make an entity qualified for ISD registration:

Key Conditions for ISD Registration:

-

Nature of the Office: The applicant must be a head office, corporate office, or any other centralized office that does not supply goods or services directly but receives common input service invoices used by multiple units or branches.

-

Receipt of Input Service Invoices: The entity must receive tax invoices for input services that are utilized by branches or units with separate GSTINs under the same PAN.

-

Location Requirement: The ISD must be located at the premises where common input services are actually received, making that office the eligible one for ITC distribution.

-

Distribution of ITC – Including RCM: The ISD must be capable of distributing the Input Tax Credit (ITC) on such common services. This also includes services on which GST is paid under the Reverse Charge Mechanism (RCM).

-

Multiple ISD Registrations (Optional): If the business receives common services at multiple locations, it can obtain separate ISD registrations for each such office in different states or districts.

-

Mandatory Issuance of ISD Invoice: To distribute ITC to the appropriate branches, the ISD must issue an ISD invoice in the prescribed format, clearly reflecting the CGST, SGST/UTGST, or IGST distributed to other GSTINs under the same PAN.

When Input Service Distributor (ISD) Mechanism Does Not Apply

While the ISD concept allows centralized distribution of input tax credit (ITC) for input services, there are certain situations where it cannot be used. It is important to know these exclusions to avoid non-compliance.

-

No Distribution for Inputs and Capital Goods:

- The ISD mechanism is strictly limited to input services.

- It cannot be used to distribute ITC related to:

- Inputs – such as raw materials, packing materials, etc.

- Capital Goods – like machinery, computers, vehicles, etc.

Example: If a company’s head office purchases factory machinery used in a branch, it *cannot distribute the ITC of that machinery through ISD.

2. No Distribution to External Entities:

- ISD credit distribution is allowed only to units or branches under the same PAN with distinct GSTINs.

- It cannot distribute ITC to:

- Outsourced vendors

- Third-party manufacturers

- Contractual service providers

Example: If software support is received centrally but used by an outsourced tech support partner, the ITC cannot be passed on through ISD.

The ISD route is exclusively for input services, and the recipients must be internal branches or units of the same legal entity. Any attempt to extend it beyond this scope may lead to rejection of credit or penalties under GST law.

Key Legal Provisions Governing ISD:

Definition – Section 2(61) of the CGST Act:

The term Input Service Distributor (ISD) is legally defined here. According to this section:

- An ISD is an office of a registered supplier that receives tax invoices for input services (not for goods or capital goods).

- These services may include those covered under the reverse charge mechanism, i.e., taxed under Section 9(3) or 9(4) of the CGST Act.

- The services must be received on behalf of multiple branches or units of the same entity (known as “distinct persons” under Section 25 of the CGST Act).

- The ISD is responsible for distributing the input tax credit (ITC) to the respective units in the manner prescribed under Section 20.

Distribution Mechanism – Section 20 of the CGST Act:

This section lays down how ITC should be distributed by an ISD. It includes:

- Rules for proportional distribution of ITC,

- Treatment of eligible vs ineligible credit,

- Conditions for distributing CGST, SGST, and IGST across states.

Supporting CGST Rules:

Rule 39 – Procedure for Distribution of ITC:

This rule provides the step-by-step compliance process that ISDs must follow when allocating input tax credit. It covers:

- Allocation based on turnover ratio,

- Handling of eligible and ineligible credit,

- Documentation requirements.

Rule 54(1) – ISD Invoice Requirements:

This rule mandates that ISDs must issue a special invoice, called an ISD Invoice, when distributing credit. It includes:

- Format and content of ISD invoices,

- Reference to original service invoice,

- GSTIN details of recipient branches.

Why Register as an Input Service Distributor (ISD)?

The ISD mechanism under GST is designed as a strategic compliance tool for businesses with centralized operations but multiple locations across India. Its purpose goes beyond mere distribution—it enhances transparency and ensures optimal utilization of tax credits.

Centralized Control, Decentralized Benefit

When a company incurs common input service expenses (such as consulting, software licenses, or audit services) at a head office or central location, but those services benefit multiple branches, the ISD registration allows the head office to fairly distribute the Input Tax Credit (ITC) to the respective GSTINs.

Core Objectives of ISD Registration:

- Efficient Credit Allocation: Ensures input tax credit is passed on to the right branch/unit, based on usage or turnover, promoting fair ITC distribution.

- Centralized Accounting Compliance: Businesses that handle common vendor payments from a single office can manage GST compliance in an organized manner.

- Enhancing Credit Flow: Facilitates a seamless and uninterrupted ITC chain throughout the organization, avoiding credit blockages.

- Reducing Compliance Burden at Branches: Individual branches do not have to claim or justify common input services—this responsibility is centralized under the ISD.

Compliance Checklist for Input Service Distributors (ISD)

To operate legally and effectively under the Input Service Distributor (ISD) mechanism in GST, certain conditions must be met. These ensure smooth distribution of input tax credit (ITC) and adherence to statutory obligations.

1. Compulsory ISD Registration

- Any business entity that wishes to act as an Input Service Distributor (ISD) must obtain a separate GST registration.

- This registration is in addition to the normal taxpayer registration under GST.

- While applying via Form GST REG-01, the applicant must select the ISD option under Serial No. 14.

- Important: ITC can only be distributed after the ISD registration is completed and approved.

2. Issuing ISD Invoices

- To pass on the input tax credit to eligible branches or units, the ISD must issue a special ISD invoice.

- This invoice must follow the format prescribed under Rule 54(1) of the CGST Rules and include all required details, such as:

- GSTIN of the recipient

- Tax amount distributed

- Nature of credit (CGST/SGST/IGST)

3. Monthly Return Filing – GSTR-6

- Every ISD must file Form GSTR-6 to report the distribution of Input Tax Credit (ITC) each month.

- This return must be submitted by the 13th of the month following the relevant tax period.

- The available ITC for distribution is auto-populated based on Form GSTR-2B, which provides a summary of all inward supplies.

- A key condition: The total ITC distributed cannot exceed the credit available at the end of that month.

4. Credit Reflection for Recipients

- Once GSTR-6 is filed by the ISD, the distributed ITC becomes visible to recipient branches in Form GSTR-6A, which is automatically generated.

- These branches can then claim the credit in their own GSTR-3B return by including the eligible distributed amounts.

5. No Obligation to File GSTR-9

-

ISDs are exempted from filing the annual GST return (Form GSTR-9), as they do not make outward supplies and only distribute credit.

Standard Structure of an ISD Invoice under GST

Under the GST regime, an Input Service Distributor (ISD) is required to issue a specific invoice format while distributing input tax credit (ITC) to its branches or units. This format is governed by Rule 54(1) of the CGST Rules and must include mandatory fields to ensure transparency and traceability.

Essential Components of an ISD Invoice:

When an ISD allocates credit to a recipient unit, the invoice must include the following key particulars:

- Legal Name and Address of the ISD– The registered business name and location of the ISD issuing the invoice.

- GSTIN of the ISD– The unique 15-digit GST Identification Number allotted to the ISD.

- Invoice Serial Number– A unique and consecutive number, which should be specific to a financial year.

- Date of Issue– The actual date on which the ISD invoice is generated.

- Name and Address of the Recipient Unit– Details of the branch/unit receiving the credit.

- GSTIN of the Recipient Branch– The GST Identification Number of the unit to whom the credit is being transferred.

- ITC Amount Being Distributed– The value of input tax credit being passed on, along with tax break-up (CGST, SGST, IGST as applicable).

- Signature or Digital Signature of Authorized Representative– Must be signed by the ISD’s authorized signatory or affixed with a digital signature.

Important Notes:

- The ISD invoice does not involve any actual supply of goods or services, it is solely for credit distribution.

- The format and contents are critical for audit and compliance, and any deviation can lead to denial of credit to the recipient.

Guidelines for the Distribution of Input Tax Credit (ITC) by ISD

The Input Service Distributor (ISD) must follow specific rules laid down under the GST framework while distributing ITC to ensure fair and proportionate allocation. Below are the conditions and principles that govern this process:

1. Timely Distribution of ITC

- Any Input Tax Credit available for distribution in a particular calendar month must be distributed within the same month.

- These details must be furnished in the monthly return—Form GSTR-6.

2. Distribution of ITC on Reverse Charge

- Credit of GST paid under the Reverse Charge Mechanism (RCM) as per Section 9(3) and 9(4) of the CGST Act is also eligible to be distributed by the ISD.

- This ensures centralized payment and efficient allocation of such expenses.

3. Credit Specific to a Single Unit

- If a service is consumed exclusively by a specific branch or unit, the ITC related to that service must only be distributed to that particular recipient.

- Such credits cannot be allocated to any other branch.

4. Credit for Common Services Among Select Branches

- If a service is used by two or more (but not all) recipient units, the corresponding ITC must be distributed only among those specific branches.

- The distribution must be done in a proportionate ratio based on their turnover during the relevant period.

Formula:

5. Credit for Common Services Used by All Units

- If the input service benefits all branches across India, the ITC must be distributed proportionately to all operational recipients.

- The same turnover-based formula, as stated above, will be used for proportionate allocation.

6. Mode of Distributing Different Types of Tax Credit

Each type of GST—CGST, SGST, and IGST—is to be distributed following these rules:

| Type of Input Tax Credit | Recipient in Same State | Recipient in Different State |

|---|---|---|

| CGST | As CGST | As IGST |

| SGST | As SGST | Not Applicable (as SGST cannot be transferred inter-state) |

| IGST | As IGST | As IGST |

Consequences of Ignoring ISD Compliance under GST

Non-adherence to the legal provisions governing Input Service Distributor (ISD) can lead to significant financial and regulatory setbacks for a business. Below are the key repercussions:

1. Loss of Input Tax Credit (ITC)

If input service invoices meant for distribution are received using a regular GSTIN instead of the designated Input Service Distributor (ISD) GSTIN, the entity may lose eligibility to claim or distribute the ITC. This disrupts the seamless credit chain and increases tax costs.

2. Increased Audit and Compliance Exposure

Failure to comply with ISD registration and operational requirements raises red flags during departmental audits, potentially resulting in increased scrutiny, time-consuming reconciliations, and compliance delays.

3. Interest and Monetary Penalties

Incorrect distribution of ITC—whether due to misapplication of Input Service Distributor (ISD) rules or resorting to cross-charging in place of ISD—can lead to:

- Tax demand notices under Section 73 or 74 of the CGST Act

- Interest liability at 18% per annum on ineligible credit

- Monetary penalty up to ₹25,000 for each violation

Important Takeaway:

Registering as an ISD and adhering to the prescribed mechanism is not optional when common input services are used across multiple GSTINs. Non-compliance can affect not only the working capital but also the legal standing of your business under GST.

Recovery Mechanism for Incorrect ITC Distribution by ISD

The GST law clearly outlines the course of action to be taken when an Input Service Distributor (ISD) distributes credit incorrectly. Any misallocation of Input Tax Credit (ITC) is treated as a serious compliance lapse, and recovery procedures are triggered under the law.

What Constitutes Improper Distribution?

The following scenarios are considered wrongful distribution of credit by an ISD:

- Excess Credit Allocation– When the ISD distributes more credit than what is available in its pool.

- Incorrect Apportionment– If the ITC is allocated in a disproportionate or unjustified manner to one or more recipient units, it violates the turnover-based ratio rule.

- Credit Distributed Beyond Eligibility– When the distributed credit exceeds the amount the supplier was legally entitled to claim, even if passed on in good faith.

Consequences and Recovery Process

In such cases of irregular distribution:

- Recovery proceedings are initiated against the recipient branch/unit that wrongly availed the excess credit.

- The entire excess ITC, along with interest, is recoverable.

- The process follows the provisions outlined under the ‘Demand and Recovery’ chapter of the CGST Act.

Legal Reference:

These actions are covered under Sections 73 and 74 of the CGST Act, which deal with the recovery of tax in cases of error, fraud, or willful misstatement.